Navigating HOA Taxes: Deadlines, Forms, and Expert Tips

/Homeowners’ associations (HOAs) are generally classified as corporations for federal tax purposes and must file annual tax returns. Even if an HOA is organized as a non-profit at the state level, it typically doesn’t qualify for federal tax-exempt status under Section 501(c)(4) unless it meets specific criteria, such as serving the general public rather than just its members.

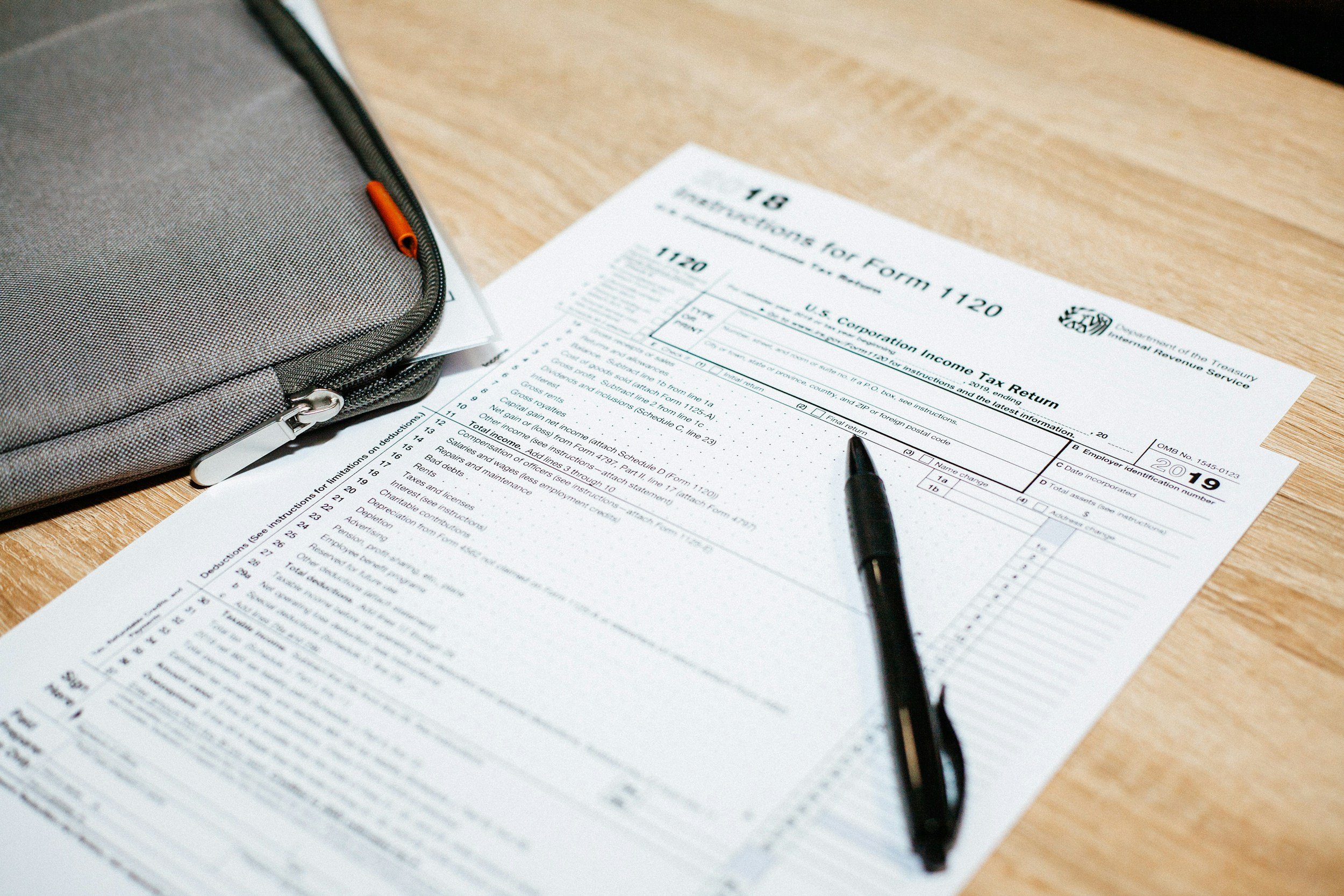

HOAs have two primary options for filing federal taxes:

1. Form 1120-H (U.S. Income Tax Return for Homeowners Associations): This form is tailored for HOAs, allowing them to exclude exempt function income—like membership dues and assessments—from gross income. The taxable income is subject to a flat rate of 30% for condominium management associations and residential real estate associations.

2. Form 1120 (U.S. Corporation Income Tax Return): While this form offers a lower tax rate of 21% on net income, it requires more detailed financial reporting and doesn’t provide the same exclusions for exempt function income. HOAs should compare their tax liabilities under both forms annually to determine the most advantageous option.

It’s essential for HOAs to file their tax returns by the 15th day of the fourth month after the end of their tax year, typically April 15 for calendar-year associations. Late filings can result in penalties and interest. Given the complexities of HOA taxation, consulting a certified public accountant (CPA) experienced in this area is advisable to ensure compliance and optimize tax outcomes.

For more detailed information, refer to the IRS guidelines on homeowners’ associations. If you have questions, your HOA manager can provide additional information or connect you with qualified professionals who specialize in HOA taxation.

Editor’s Note: The above information is only provided for general informational purposes and derived largely from the IRS website.